what is suta tax texas

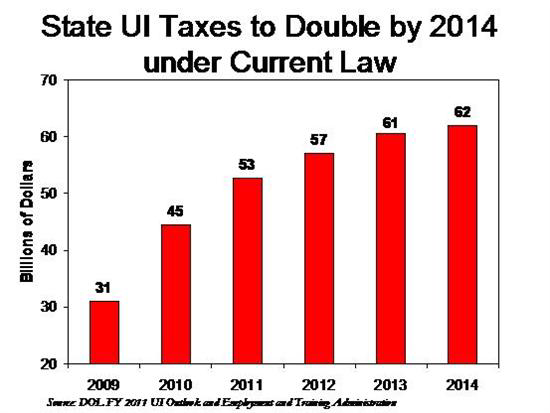

An employers SUI rate is the sum of five components. Generally states have a range of unemployment tax rates for established employers.

What Are Employer Taxes And Employee Taxes Gusto

Heres how an employer in Texas would calculate SUTA.

. Lets say your business is in New York where the lowest SUTA tax rate for 2021 was 2025 and the highest was 9825 and youre assigned a rate of 4025. The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require employers to pay. The FUTA and SUTA taxes are filed on Form 940 each year regardless if a business has an employee on unemployment insurance.

As of February 2019 the Federal Unemployment Tax Act FUTA and Texas State Unemployment Tax Act SUTA are only applied to the first 7000 and 9000 of an employees. Unemployment Tax Registration - Texas Workforce Commission. The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers.

SUTA was established to provide unemployment benefits to. Tax rate Each state sets a range of minimum and maximum tax rates for SUTA taxes. The yearly cost is.

Using Unemployment Tax Registration. Who pays Suta in Texas. Staying with the Texas example the minmax tax rate for 2020 ranged from 031 to 631.

Employers must register with the Texas Workforce. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636. General Tax Rate Replenishment Tax Rate Unemployment Obligation Assessment Deficit Tax Rate and Employment and Training.

Typically SUTA taxes are due at the end of the month following the end of each quarter. Assume that your company receives a good assessment and your. The FUTA tax rate is a flat 6 but is reduced to just.

The State Unemployment Tax Act known as SUTA is a payroll tax employers are required to pay on behalf of their employees to their state unemployment fund. For employees who work in only one state SUTA taxes are paid to the state where the. You can get tax rate information and a detailed listing of the individuals making up the three-year total of benefit chargebacks used in your Benefit Ratio online or by phone fax.

9000 taxable wage base x 27 tax rate x number of employees Texas SUTA cost for the year. 52 rows Most states send employers a new SUTA tax rate each year. The Texas Workforce Commission TWC set the 2021 employers unemployment insurance UI tax rate in mid-June after a four-month delay as the state waited to see how the.

What Is Sui State Unemployment Insurance Tax Ask Gusto

Florida Payroll Software Payroll Software Payroll Florida

What Is Sui State Unemployment Insurance Tax Ask Gusto

2022 Federal Payroll Tax Rates Abacus Payroll

How Does Unemployment Insurance Work And How Is It Changing During The Coronavirus Pandemic

Employment Tax Returns Forms Due Dates More

What Is Futa Tax 2021 Tax Rates And Information

Suta Tax Your Questions Answered Bench Accounting

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Payroll Services In Texas Payroll Taxes Gov Links Payroll Taxes Payroll Payroll Software

Our Company Is Agricultural And Not Required To Pay Futa Or Suta How Can I Reflect This In Quickbooks So It Stops Calculating Those Taxes

Suta Tax An Employer S Guide To The State Unemployment Tax Act

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

What Is The Futa Tax 2022 Tax Rates And Info Onpay

Futa Tax Overview How It Works How To Calculate